Auto Policy Quotes vs Full Coverage: Whats the Real Difference?

When it comes to Auto Policy Quotes vs Full Coverage: What’s the Real Difference?, the distinction between the two can often be confusing. This detailed exploration aims to shed light on the nuances and help you make informed decisions when it comes to your insurance needs.

Exploring the intricacies of auto policy quotes and full coverage, this discussion delves into the key factors that differentiate the two and how they can impact your insurance choices.

Understanding Auto Policy Quotes

When it comes to auto insurance, understanding auto policy quotes is essential for selecting the right coverage for your vehicle. Auto policy quotes provide an estimate of the cost of insurance based on various factors.

Components of an Auto Policy Quote

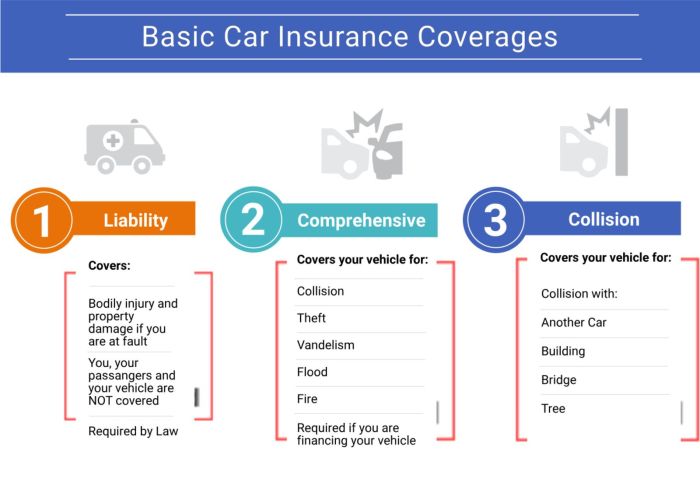

- The type of coverage required (liability, comprehensive, collision, etc.)

- The limits of coverage for each component

- The deductible amount

- Any additional coverage or endorsements

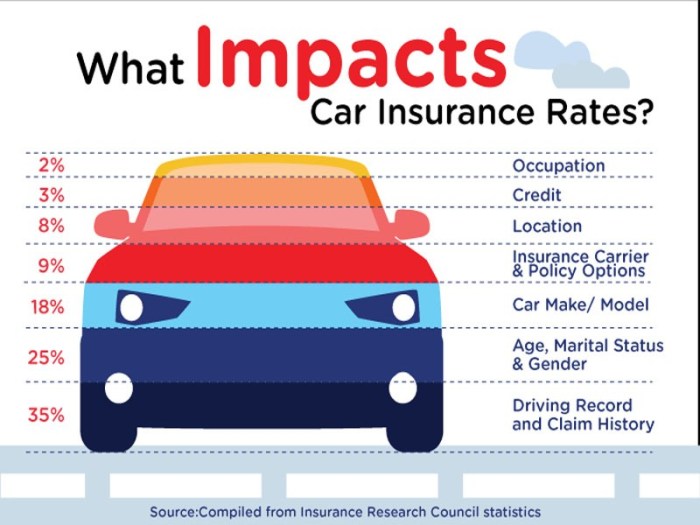

Factors Influencing Auto Policy Quotes

- Driver's age, driving record, and location

- Type of vehicle being insured

- Mileage driven annually

- Credit score

Comparison with Full Coverage

Auto policy quotes typically refer to the minimum coverage required by law, while full coverage includes additional protection such as comprehensive and collision coverage. Full coverage is more expensive but offers greater protection in case of accidents or damage.

Obtaining Auto Policy Quotes

To obtain auto policy quotes, you can contact insurance providers directly, use online comparison tools, or work with an insurance agent. You will need to provide information about your driving history, vehicle details, and coverage preferences to receive accurate quotes.

Exploring Full Coverage Insurance

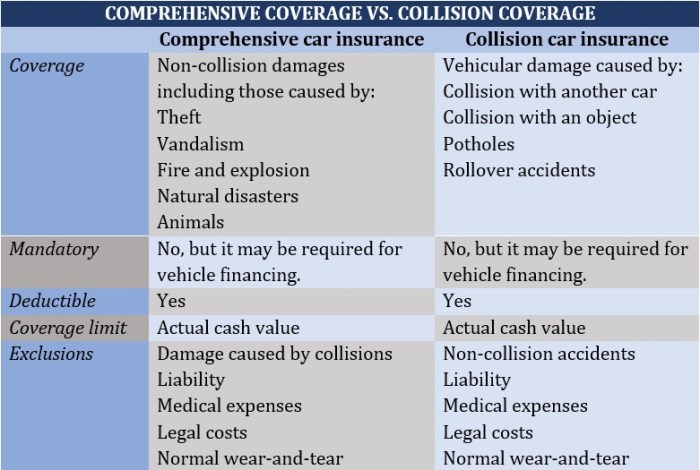

When it comes to auto insurance, full coverage typically includes both liability coverage and comprehensive/collision coverage. Liability coverage protects you if you're at fault in an accident and covers the other party's medical bills and property damage. Comprehensive/collision coverage, on the other hand, helps pay for repairs or replacements to your own vehicle in case of accidents, theft, or natural disasters.

Benefits of Full Coverage Insurance

- Full protection for your vehicle in various situations such as accidents, theft, or damage from natural disasters.

- Peace of mind knowing that you have coverage for both your own vehicle and others involved in an accident.

- Potentially lower out-of-pocket expenses for repairs or replacements.

Cost Implications

Opting for full coverage insurance generally results in higher premiums compared to basic auto policy quotes. The added protection and coverage for your vehicle contribute to the increased cost. However, the peace of mind and potential savings in case of accidents or damages can outweigh the higher premiums for some drivers.

Difference in Coverage

The main difference between auto policy quotes and full coverage lies in the extent of protection provided. Auto policy quotes may only include basic liability coverage, leaving your own vehicle unprotected in certain situations. On the other hand, full coverage insurance offers a more comprehensive level of protection for both your vehicle and others involved in an accident.

Factors Affecting Premiums

When it comes to determining insurance premiums for auto policies and full coverage, several factors come into play. These factors can significantly impact how much you pay for your coverage. Let's dive into the key elements that influence premium rates.

Type of Coverage and Premiums

The type of coverage you choose directly affects your insurance premiums. Auto policy quotes generally offer basic coverage options, such as liability insurance, which tend to be more affordable. On the other hand, full coverage insurance includes comprehensive and collision coverage, resulting in higher premiums due to the increased level of protection.

Driving Record and Premiums

Your driving record plays a critical role in determining both auto policy quotes and full coverage premiums. A clean driving record with no accidents or traffic violations typically leads to lower premium rates. Conversely, a history of accidents or tickets can significantly increase your insurance costs.

Vehicle Make, Model, and Year Impact

The make, model, and year of your vehicle also impact insurance costs. High-end luxury cars or sports vehicles are more expensive to insure due to their higher repair and replacement costs. Older vehicles may have lower premiums since they are less expensive to repair or replace.

Deductible Choices and Premiums

Your deductible choice can affect premiums for both auto policy quotes and full coverage. A higher deductible means you'll pay more out of pocket in the event of a claim, but your premiums will be lower. Conversely, a lower deductible results in higher premiums but less money upfront if you need to file a claim.

Making Informed Decisions

When it comes to choosing between auto policy quotes and full coverage insurance, it's crucial to have a clear understanding of the differences to make an informed decision that suits your needs.

The Importance of Understanding the Difference

Auto policy quotes typically provide basic coverage for your vehicle, focusing on meeting state minimum requirements. On the other hand, full coverage insurance offers comprehensive protection, including collision and comprehensive coverage, along with liability insurance. Understanding this distinction is essential in determining the level of protection you require.

Designing a Guide for Decision-Making

- Evaluate your vehicle's value and your driving habits to determine the level of coverage needed.

- Consider your budget and risk tolerance to decide between auto policy quotes and full coverage.

- Review the specific coverage options and limits offered by each type of insurance to make an informed choice.

Common Misconceptions

- One common misconception is that auto policy quotes are always the most affordable option, but this may not provide sufficient coverage in case of an accident.

- Another misconception is that full coverage is unnecessary for older vehicles, but it can still offer valuable protection in certain situations.

Significance of Reading the Fine Print

When comparing auto policy quotes and full coverage options, it's crucial to read the fine print to understand the specific coverage details, exclusions, deductibles, and limits. This ensures that you are fully aware of what is covered and can make a well-informed decision based on your needs.

Conclusion

In conclusion, understanding the disparities between auto policy quotes and full coverage is crucial in making sound insurance decisions. By grasping the intricacies of each, you can navigate the insurance landscape with confidence and clarity.

Top FAQs

What factors influence auto policy quotes?

Auto policy quotes are influenced by various factors such as age, driving record, location, and the type of coverage desired. Insurers consider these factors to determine the premium rates.

Is full coverage insurance always more expensive than auto policy quotes?

Full coverage insurance typically comes with higher premiums compared to basic auto policy quotes due to the comprehensive nature of coverage it provides.

How can deductible choices impact premiums for auto policy quotes and full coverage?

Choosing a higher deductible can lower premiums for both auto policy quotes and full coverage, but it also means you'll have to pay more out of pocket in the event of a claim.