Full Coverage Insurance Quotes: Do They Really Cover Everything?

Starting with Full Coverage Insurance Quotes: Do They Really Cover Everything?, this paragraph aims to grab the attention of readers with a captivating overview of the topic.

The following paragraph will delve into the specifics and provide a detailed look at the subject matter.

Overview of Full Coverage Insurance

Full coverage insurance is a type of auto insurance policy that typically includes both liability coverage and physical damage coverage for your vehicle. It is often seen as a comprehensive option that provides more protection than just liability-only insurance.

What Full Coverage Insurance Typically Includes

Full coverage insurance typically includes:

- Liability coverage for bodily injury and property damage

- Collision coverage for damage to your vehicle in an accident

- Comprehensive coverage for non-collision incidents like theft, vandalism, or natural disasters

Difference between Full Coverage and Liability-Only Insurance

While full coverage insurance includes a wider range of protections, liability-only insurance provides coverage for damages you cause to others but does not cover damage to your own vehicle. Understanding this difference is important in determining the level of protection you need.

Importance of Understanding the Limitations of Full Coverage Insurance

It is crucial to understand that even with full coverage insurance, there may still be limitations or exclusions in your policy. These limitations could include coverage caps, deductibles, or specific exclusions for certain types of incidents. Knowing the extent of your coverage can help you avoid surprises in the event of a claim.

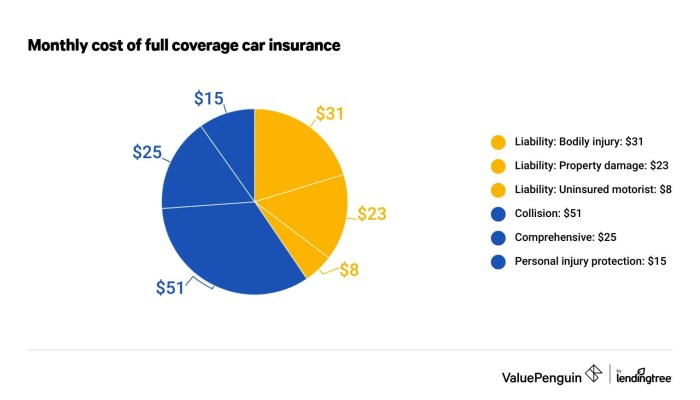

Components of Full Coverage Insurance

When it comes to full coverage insurance, there are several common components that are typically included in a policy. These components are designed to provide comprehensive protection in various situations, ensuring that you are covered in the event of unexpected circumstances.

Liability Coverage

- Liability coverage is essential in full coverage insurance as it helps protect you in case you are at fault in an accident.

- For example, if you rear-end another vehicle and are found liable for the damages, liability coverage will help cover the other driver's medical expenses and vehicle repairs.

Collision Coverage

- Collision coverage helps pay for repairs to your own vehicle if you are involved in a collision, regardless of fault.

- For instance, if you hit a tree or another car, collision coverage will assist in covering the cost of repairing your vehicle.

Comprehensive Coverage

- Comprehensive coverage protects your vehicle from non-collision related incidents, such as theft, vandalism, or natural disasters.

- For example, if your car is stolen or damaged in a hailstorm, comprehensive coverage will help cover the costs of repair or replacement.

Uninsured/Underinsured Motorist Coverage

- This coverage protects you if you are in an accident with a driver who does not have insurance or enough insurance to cover your damages.

- In a scenario where you are hit by an uninsured driver, uninsured/underinsured motorist coverage will help cover your medical expenses and vehicle repairs.

Additional Coverage Options

- Rental Reimbursement: Covers the cost of a rental car if your vehicle is in the shop for repairs after an accident.

- Roadside Assistance: Provides help in case of a breakdown, flat tire, or running out of gas.

- GAP Insurance: Pays the difference between what you owe on your car loan and the actual cash value of your vehicle if it is totaled.

Understanding Coverage Limits

When it comes to full coverage insurance, understanding coverage limits is crucial to ensuring you have the right level of protection in place. Coverage limits refer to the maximum amount your insurance provider will pay out for a covered claim.

How Coverage Limits Work

- Insurance policies typically have separate coverage limits for different types of coverage, such as liability, collision, and comprehensive.

- For example, if your liability coverage limit is $100,000, your insurance will only pay up to that amount for damages you are legally responsible for in an accident.

- It's important to review and adjust your coverage limits based on your individual needs and assets to ensure you are adequately protected.

Significance of Choosing Appropriate Coverage Limits

- Choosing the right coverage limits is essential to avoid being underinsured or overpaying for coverage you don't need.

- Having adequate coverage limits can protect you financially in the event of a costly accident or lawsuit.

- Consider factors like your assets, income, and risk tolerance when determining the appropriate coverage limits for your insurance policy.

Examples of Scenarios Impacting Coverage Limits

- If you're in a car accident and the other driver sues you for medical expenses exceeding your liability coverage limit, you may be personally responsible for the remaining amount.

- In the event of a natural disaster, such as a hurricane or flood, having sufficient coverage limits for comprehensive insurance can help cover the cost of repairs to your vehicle or home.

- Choosing higher coverage limits may result in slightly higher premiums, but it can provide you with greater peace of mind and protection in the long run.

Exclusions in Full Coverage Insurance

When it comes to full coverage insurance, it's important to understand that not everything is covered. Exclusions are specific situations or items that are typically not covered by your insurance policy. Knowing these exclusions is crucial to avoid any surprises when filing a claim.

Common Exclusions

- Intentional damage or illegal activities: Any damage caused intentionally or as a result of illegal activities will not be covered by your full coverage insurance.

- Wear and tear: Normal wear and tear on your vehicle or property is not covered by insurance.

- Natural disasters: Some natural disasters like earthquakes or floods may require separate insurance coverage.

- Commercial use: If your vehicle is used for commercial purposes, it may not be covered under a personal full coverage insurance policy.

Importance of Understanding Exclusions

- Prevents surprises: Knowing what is not covered helps you avoid surprises when you need to file a claim.

- Allows for proper planning: Understanding exclusions allows you to plan ahead and consider additional coverage if needed.

- Avoids financial strain: Being aware of exclusions can prevent financial strain in case of uncovered incidents.

Tips to Mitigate Risks

- Review your policy: Take the time to thoroughly review your full coverage insurance policy to understand all exclusions.

- Consider additional coverage: If you identify potential gaps in coverage, consider adding supplemental insurance to fill those gaps.

- Maintain your property: Regular maintenance and care of your property can help prevent issues that may not be covered due to wear and tear exclusions.

Ultimate Conclusion

Concluding our discussion on Full Coverage Insurance Quotes: Do They Really Cover Everything?, this final paragraph will wrap up the key points in a compelling manner.

Expert Answers

What does full coverage insurance typically include?

Full coverage insurance usually includes comprehensive and collision coverage along with liability coverage.

How does coverage limits work in full coverage insurance?

Coverage limits determine the maximum amount your insurance company will pay for covered claims.

What are common exclusions in full coverage insurance?

Common exclusions may include intentional damage, wear and tear, and certain types of natural disasters.