Understanding the Importance of a General Contractor Surety Bond

Delving into the realm of general contractor surety bonds opens up a world of protection and assurance in the construction industry. From safeguarding financial interests to ensuring project completion, these bonds play a crucial role in fostering trust and reliability among stakeholders.

Let's explore the ins and outs of general contractor surety bonds to grasp their significance in construction projects.

What is a general contractor surety bond?

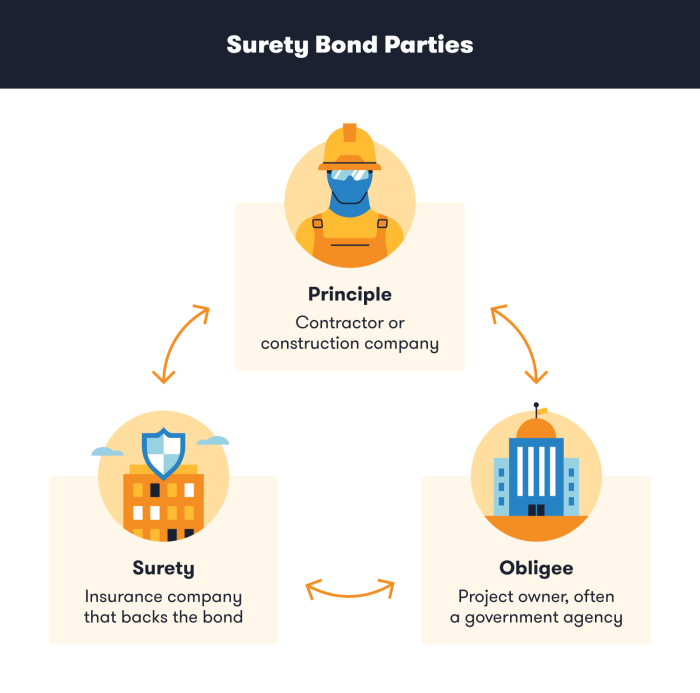

A general contractor surety bond is a type of contract between three parties: the principal (the general contractor), the obligee (the project owner or government entity), and the surety (the insurance company providing the bond). This bond guarantees that the general contractor will fulfill their obligations as Artikeld in the contract.

Purpose of a general contractor surety bond

A general contractor surety bond serves as a form of protection for the obligee in case the general contractor fails to complete the project or meet other requirements specified in the contract. It provides financial security and ensures that the project will be completed according to the terms agreed upon.

- Protects project owners: The bond protects project owners from financial loss if the general contractor fails to complete the project.

- Ensures contractor performance: It motivates general contractors to fulfill their contractual obligations to avoid financial consequences.

- Enhances trust: Having a surety bond in place enhances trust between project owners and general contractors, as it demonstrates the contractor's commitment to completing the project.

How a general contractor surety bond works

When a general contractor obtains a surety bond, the surety company assesses the contractor's financial stability, reputation, and past performance to determine the bond premium. If the general contractor fails to meet the contract terms, the obligee can file a claim with the surety company to recover financial losses.

The surety will then investigate the claim and, if valid, compensate the obligee up to the bond amount.

It's essential for general contractors to maintain a good track record and financial standing to qualify for surety bonds and avoid potential claims.

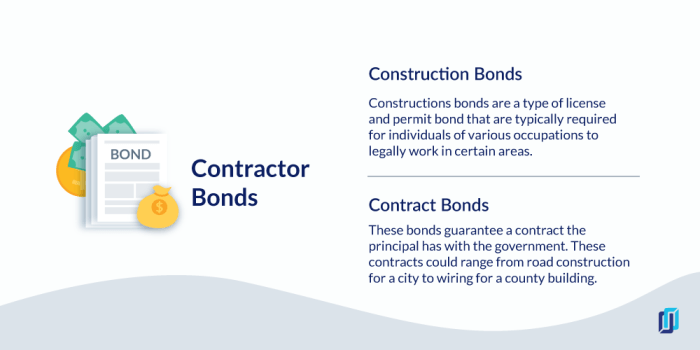

Types of general contractor surety bonds

When it comes to general contractor surety bonds, there are several types that serve different purposes in the construction industry. Let's explore the most common ones.

Performance bonds

Performance bonds are a type of general contractor surety bond that guarantees the contractor will complete the project according to the terms of the contract. If the contractor fails to fulfill their obligations, the bond will cover the losses suffered by the project owner.

This bond provides financial protection and ensures that the project is completed as agreed upon.

Payment bonds

Payment bonds are another essential type of general contractor surety bond that guarantees subcontractors and suppliers will be paid for their work and materials. In the event that the contractor fails to make payments, the bond will cover the outstanding amounts owed.

Payment bonds help protect the rights of subcontractors and suppliers involved in a construction project.

Bid bonds

Bid bonds are typically required during the bidding process for a construction project. These bonds ensure that the contractor submitting a bid is serious about the project and has the financial backing to take on the job if awarded. If the contractor backs out or fails to honor the bid, the bond compensates the project owner for the additional costs incurred in selecting another contractor.

Bid bonds help promote fairness and integrity in the bidding process.

Requirements and eligibility for obtaining a general contractor surety bond

To secure a general contractor surety bond, certain qualifications must be met. These qualifications determine the eligibility of a contractor to obtain the bond. Factors such as financial stability play a crucial role in the approval process for a general contractor surety bond.

Qualifications Needed for a General Contractor Surety Bond

- Valid contractor's license: To qualify for a general contractor surety bond, the contractor must hold a valid license in the state where they operate.

- Good credit score: A strong credit history is essential as it demonstrates the contractor's ability to fulfill financial obligations.

- Experience in the industry: Contractors with a proven track record of successful projects are more likely to be eligible for a surety bond.

- No history of bond claims: A clean claims history indicates reliability and trustworthiness, making it easier to obtain a general contractor surety bond.

Factors Influencing Eligibility for a General Contractor Surety Bond

- Financial stability: Contractors must demonstrate financial stability to ensure they can meet their obligations under the bond.

- Risk assessment: Surety companies assess the level of risk associated with issuing a bond to a particular contractor based on various factors.

- Business reputation: A positive reputation in the industry can increase the chances of approval for a general contractor surety bond.

Importance of Financial Stability When Applying for a General Contractor Surety Bond

Maintaining financial stability is crucial when applying for a general contractor surety bond. It reassures the surety company that the contractor has the resources to complete projects and fulfill their contractual obligations. A strong financial standing reflects positively on the contractor's ability to manage finances effectively and instills confidence in the surety provider.

Benefits of having a general contractor surety bond

Having a general contractor surety bond offers several advantages that benefit all parties involved in a construction project. It provides financial protection, ensures project completion, and enhances credibility in the industry.

Financial Protection

- General contractor surety bonds protect project owners from financial losses due to contractor default or failure to complete the project.

- Subcontractors and suppliers are also safeguarded by the bond, ensuring they receive payment for services and materials provided.

- Claims can be made against the bond in case of non-performance, providing a financial safety net for all parties involved.

Project Completion Assurance

- Having a surety bond in place guarantees that the project will be completed as per the terms of the contract, even if the contractor faces challenges or goes out of business.

- Surety companies step in to ensure project completion, preventing delays and disruptions that could impact timelines and budgets.

Enhanced Credibility and Trustworthiness

- General contractors with surety bonds demonstrate financial stability and reliability, enhancing their reputation in the industry.

- Project owners prefer working with bonded contractors as it signifies a commitment to fulfilling obligations and delivering quality work.

- Having a surety bond can differentiate a contractor from competitors and attract more opportunities for projects.

Cost and Process of Obtaining a General Contractor Surety Bond

When it comes to obtaining a general contractor surety bond, there are costs involved and a specific process that needs to be followed. Understanding these aspects is crucial for contractors looking to secure this type of bond.

Cost Breakdown

- The cost of a general contractor surety bond is typically a percentage of the total bond amount required. This percentage can vary depending on factors such as the contractor's credit score, financial history, and the size of the project.

- Contractors can expect to pay anywhere from 1% to 15% of the total bond amount as a premium for the surety bond.

- Additional fees may also apply, such as underwriting fees, processing fees, and administrative costs.

Application Process

- Contractors interested in obtaining a general contractor surety bond need to start by filling out an application with a surety bond company or agency.

- The application will require detailed information about the contractor's business, financial standing, previous work experience, and the specific project requiring the bond.

- The surety bond company will then assess the contractor's creditworthiness, financial stability, and ability to fulfill the obligations Artikeld in the bond agreement.

- Once approved, the contractor will need to sign the bond agreement and pay the required premium to activate the bond.

Tips for Cost Reduction and Expedited Process

- Maintain a strong credit score and financial history to qualify for lower premium rates.

- Provide all necessary documentation and information accurately and promptly to expedite the underwriting process.

- Work with a reputable surety bond company that specializes in general contractor bonds to ensure a smooth and efficient application process.

- Consider bundling multiple bonds or projects with the same surety bond company to potentially qualify for discounts or reduced rates.

Outcome Summary

In conclusion, a general contractor surety bond acts as a safety net, providing peace of mind and security for all parties involved in a construction venture. By understanding its benefits and requirements, individuals can navigate the complexities of the construction industry with confidence and integrity.

Clarifying Questions

What is the main purpose of a general contractor surety bond?

The primary function of a general contractor surety bond is to ensure that the contractor fulfills their obligations and pays subcontractors, laborers, and suppliers.

What factors affect eligibility for obtaining a general contractor surety bond?

Eligibility is influenced by the contractor's credit history, financial stability, and past experience in completing similar projects.

How can a general contractor surety bond improve credibility in the construction industry?

Having a surety bond demonstrates financial strength and reliability, enhancing a contractor's reputation and trustworthiness among clients and partners.