The Truth About Life and Critical Illness Cover: Unveiling Financial Protection

Delving into the realm of Life and Critical Illness Cover brings forth a crucial discussion on safeguarding our financial well-being. As we navigate through the nuances of this topic, we uncover the layers of security and peace of mind it offers to individuals and their loved ones.

What is Life and Critical Illness Cover?

Life and Critical Illness Cover is a type of insurance policy that provides financial protection in the event of death or diagnosis of a critical illness. This type of cover is designed to offer peace of mind and security to individuals and their families during difficult times.

Types of Coverage Included

- Life Insurance: This coverage provides a lump sum payment to the beneficiaries of the policyholder in the event of their death. It helps replace lost income and cover expenses such as funeral costs, debts, and mortgage payments.

- Critical Illness Insurance: This coverage pays out a lump sum if the policyholder is diagnosed with a critical illness specified in the policy, such as cancer, heart attack, or stroke. The funds can be used for medical treatment, rehabilitation, or any other financial needs during the illness.

- Combined Cover: Some policies offer a combination of life insurance and critical illness cover, providing comprehensive protection in case of death or critical illness. This type of cover ensures that the policyholder and their loved ones are financially secure in various scenarios.

Importance of Life and Critical Illness Cover

Life and Critical Illness Cover plays a crucial role in providing financial security and peace of mind to individuals and their families in the face of unexpected health challenges. This type of insurance offers a safety net that can help alleviate the financial burden during difficult times.

Financial Protection

- Life and Critical Illness Cover can provide a lump sum payment to cover medical expenses, loss of income, or other financial obligations in the event of a critical illness diagnosis.

- It can also offer financial support to loved ones in case of premature death, ensuring that they are taken care of and can maintain their standard of living.

- Having this cover can help prevent individuals and families from depleting their savings or going into debt to cover medical costs or other expenses related to a critical illness.

Peace of Mind

- Knowing that you have Life and Critical Illness Cover can provide a sense of security and peace of mind, allowing you to focus on recovery and healing without the added stress of financial worries.

- It offers reassurance that you and your family will be protected financially, no matter what unexpected health challenges may arise.

- Having this coverage can bring a sense of comfort and confidence, knowing that there is a plan in place to address any potential financial hardships that may come your way.

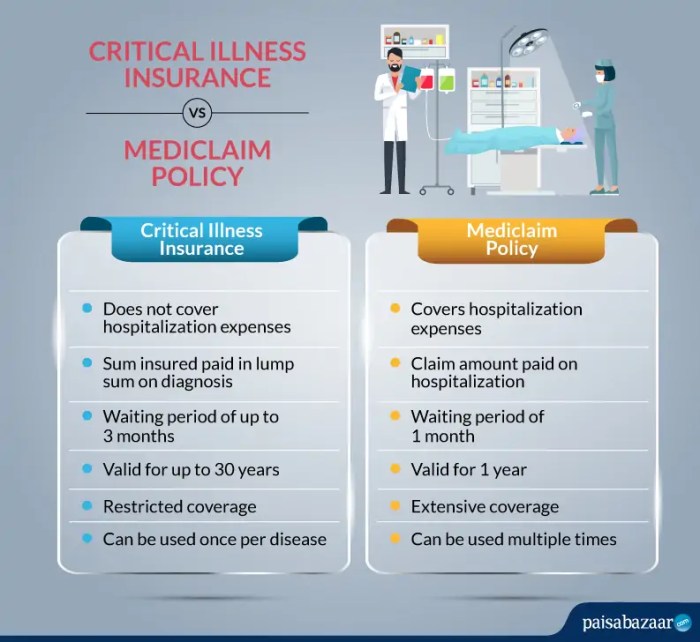

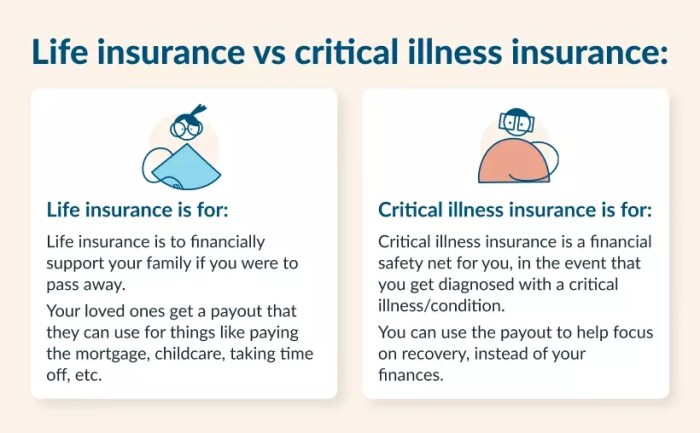

Key Differences Between Life Insurance and Critical Illness Cover

Life Insurance and Critical Illness Cover are both essential forms of financial protection, but they serve different purposes and offer distinct benefits to policyholders.

Differentiation between Life Insurance and Critical Illness Cover

Life Insurance provides a lump sum payment to the beneficiaries of the policyholder upon their death. It serves as a financial safety net for loved ones in the event of the policyholder's passing. On the other hand, Critical Illness Cover pays out a lump sum if the policyholder is diagnosed with a serious illness covered by the policy, offering financial support during a challenging time.

Comparison of Benefits

- Life Insurance offers peace of mind by ensuring that loved ones are taken care of financially after the policyholder's death.

- Critical Illness Cover provides financial assistance to cover medical expenses and other costs associated with a serious illness, allowing the policyholder to focus on recovery without worrying about finances.

Suitable Scenarios for Each Type of Coverage

- Life Insurance is ideal for individuals who want to secure their family's financial future and ensure that they are provided for in the event of their death.

- Critical Illness Cover is more suitable for those who want protection against the financial impact of a serious illness and want to ensure that they have the means to cover medical expenses and other costs during their recovery.

Factors to Consider When Choosing Life and Critical Illness Cover

When selecting Life and Critical Illness Cover, there are several important factors that individuals should take into consideration to ensure they have the right coverage in place. Factors such as age, health status, lifestyle choices, and financial obligations can significantly impact the type and amount of coverage needed.

It is essential to carefully evaluate different options available in the market to make an informed decision.

Age

Age plays a crucial role in determining the cost and availability of Life and Critical Illness Cover. Generally, the younger you are when you purchase the policy, the lower the premiums will be. Younger individuals are also less likely to have pre-existing health conditions, making it easier to qualify for coverage.

Health

Your current health status is a key factor in determining the type of coverage you can obtain. Pre-existing medical conditions can impact your eligibility for Critical Illness Cover and may result in higher premiums for both Life and Critical Illness policies.

It is important to disclose all relevant health information honestly to ensure you are adequately covered.

Lifestyle

Your lifestyle choices, such as smoking, alcohol consumption, and participation in high-risk activities, can also influence the cost and coverage of Life and Critical Illness policies. Insurers may consider these factors when assessing your application, so it is essential to be transparent about your lifestyle habits.

Financial Obligations

Consider your financial responsibilities, such as mortgage payments, debts, and the financial needs of your dependents when choosing Life and Critical Illness Cover. The coverage amount should be sufficient to cover these obligations and provide financial security for your loved ones in case of an unforeseen event.

Evaluating Options

When comparing different Life and Critical Illness Cover options, consider factors such as coverage limits, policy exclusions, premium costs, and additional benefits offered by insurers. It is advisable to seek guidance from a financial advisor to understand the terms and conditions of the policy and ensure it aligns with your specific needs and circumstances.

Final Review

In conclusion, The Truth About Life and Critical Illness Cover sheds light on the importance of securing our future against unforeseen circumstances. By understanding the distinctions and benefits of these covers, individuals can make informed decisions to protect what matters most.

Frequently Asked Questions

What is Life and Critical Illness Cover?

Life and Critical Illness Cover is a type of insurance that provides financial protection in case of death or diagnosis of a critical illness.

What are the types of coverage included in Life and Critical Illness Cover?

The coverage may include payouts upon death, diagnosis of critical illnesses such as cancer or heart disease, and sometimes disability benefits.

What are the key differences between Life Insurance and Critical Illness Cover?

Life Insurance provides coverage in case of death, while Critical Illness Cover offers protection upon diagnosis of specific critical illnesses.

What factors should individuals consider when choosing Life and Critical Illness Cover?

Important factors to consider include age, health condition, lifestyle choices, and financial responsibilities, as these can impact the choice of coverage.